From Carmignac’s UK headquarters in the heart of St James, Mark Denham manages the FP Carmignac European Leaders OEIC and its sister SICAV strategy classified Article 9 under the SFDR regulation, with a combined AUM of c.€960m (as per 03/05/24).

Can you give a brief overview of your strategy in terms of what you are trying to achieve for investors, your investment process and the make-up of the investment team?

FP Carmignac European Leaders is a Europe ex-UK equity strategy seeking to achieve capital growth over a minimum of five years. The Fund follows a fundamental selective bottom-up investment process to find quality companies, businesses with attractive long-term prospects and robust fundamentals that can grow under their own steam, irrespective of the macroeconomic environment. Our investment process follows a structured, quantifiable process with a sustainable objective. The focus is on companies which demonstrate high long-term profitability and reinvests for the future. Our investment process also includes positive screening. We allocate at least 80% of the portfolio's net assets to companies that actively contribute to the United Nations Sustainable Development Goals.

While the ultimate decision-making authority and accountability lies with me, I of course have access to the expertise of the wider investment team at Carmignac, including the Research Analysts who are sector specialists. The Analysts play a crucial role in conducting analysis in their respective areas and continuously monitoring the investment thesis on positions held in the portfolio. As Fund Manager, I oversees the portfolio construction and risk management of the strategy since its inception in 2019.

How are you currently positioning your portfolio?

The Fund continues to rely on bottom-up fundamental analysis with a medium-term horizon. We are currently significantly invested in the Healthcare sector, because of our stock picking and fundamentals-driven focus. This exposure gives our equity allocation the quality and defensive bias we believe is needed in the current economic environment. Our perspective remains cautious of the potential impact of weaker corporate and economic data. Nevertheless, we keep an eye across themes and investment opportunities to capture them in our strategy. We remain open to the possibility of a cyclical recovery and are actively exploring opportunities to incorporate cyclicality into our investment strategy, thus we added some positions in the Industrials and high-quality Luxury Goods names. The potential for greater visibility in the market is expected to yield favourable outcomes. We anticipate that as economic growth slows down, inflation will also decrease, leading to a gradual decline in interest rates.

Can you identify a couple of key investment opportunities for your fund you are playing at the moment in the portfolio? This could be at a stock, sector or thematic level.

We believe that Novo Nordisk stands to benefit significantly from the GLP-1 drug theme, as the near-term profit forecasts do not fully capture the potential strength in diabetes treatment and the resumption of supply in obesity treatment. We see this theme as one of the mega trends of the decade. Similarly, the artificial intelligence (AI) theme continues to show promising potential for future earnings growth. Investing in ASML, a disruptor in the semiconductor industry, would be advantageous as the company is well-positioned to capitalise on key structural trends such as the growth of leading-edge technology and the geographical redistribution of manufacturing capacity. Another stock that we believe holds great potential is SAP, as the transition to a Software-as-a-Service (SaaS) model enhances income visibility and predictability, making it a more valuable source of profit and supporting long-term growth. Stock selection continues to be key across sectors and we firmly believe that by carefully choosing the right stocks within them, we can identify high-quality companies that possess a competitive edge.

DISCLAIMER

FP Carmignac European Leaders

Main risks of the fund

Equity

The Fund may be affected by stock price variations, the scale of which is dependent on external factors, stock trading volumes or market capitalization.

Currency

Currency risk is linked to exposure to a currency other than the Fund's valuation currency, either through direct investment or the use of forward financial instruments.

Discretionary management

Anticipations of financial market changes made by the Management Company have a direct effect on the Fund's performance, which depends on the stocks selected.

The Fund presents a risk of loss of capital.

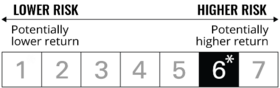

Source: Carmignac, 30/04/2024. * SRRI from the KIID (Key Investor Information Document): scale from 1 (lowest risk) to 7 (highest risk); category-1 risk does not mean a risk-free investment. This indicator may change over time.

Marketing Communication. Please refer to the KIID/prospectus of the Fund before making any final investment decisions. This document is intended for professional clients.

This material may not be reproduced, in whole or in part, without prior authorisation from the Management Company. This material does not constitute a subscription offer, nor does it constitute investment advice. The information contained in this material may be partial information and may be modified without prior notice. Access to the Funds may be subject to restrictions regarding certain persons or countries. The Funds have not been registered under the US Securities Act of 1933. The Funds may not be offered or sold, directly or indirectly, for the benefit or on behalf of a «U.S. person», according to the definition of the US Regulation S and FATCA. Company. The risks, fees and ongoing charges are described in the KIID. Investors may lose some or all their capital, as the capital in the funds are not guaranteed. The Funds' prospectus, KIIDs, NAV and annual reports are available at www.carmignac.com, or upon request to the Management Company. Investors have access to a summary of their rights in English at section 6 of "regulatory information page" on the following link: https://www.carmignac.com/en_US

Reference to certain securities and financial instruments is for illustrative purposes to highlight stocks that are or have been included in the portfolios of funds in the Carmignac range. This is not intended to promote direct investment in those instruments, nor does it constitute investment advice. The Management Company is not subject to prohibition on trading in these instruments prior to issuing any communication. The portfolios of Carmignac funds may change without previous notice.

Copyright: The data published in this presentation are the exclusive property of their owners, as mentioned on each page.

FP CARMIGNAC ICVC (the "Company") is an Investment Company with variable capital incorporated in England and Wales under registered number 839620 and is authorised by the Financial Conduct Authority (the "FCA") with effect from 04/04/2019 and launched on 15 May 2019. FundRock Partners Limited is the Authorised Corporate Director (the "ACD") of the Company and is authorised and regulated by the Financial Conduct Authority. Registered Office: Hamilton Centre, Rodney Way, Chelmsford, England, CM1 3BY, UK (Registered in England and Wales under No 4162989). Carmignac Gestion Luxembourg SA has been appointed as the Investment Manager and distributor in respect of the Company. Carmignac Gestion SA, an investment management company approved by the AMF and Carmignac UK Ltd (Registered in England and Wales with number 14162894) have been appointed as sub-Investment Managers of the Company. Carmignac UK Ltd is authorised and regulated by the Financial Conduct Authority with FRN:984288.

CARMIGNAC GESTION 24, place Vendôme - F-75001 Paris - Tel: (+33) 01 42 86 53 35 Investment management company approved by the AMF. Public limited company with share capital of € 13,500,000 - RCS Paris B 349 501 676

CARMIGNAC GESTION Luxembourg - City Link - 7, rue de la Chapelle - L-1325 Luxembourg - Tel: (+352) 46 70 60 1 Subsidiary of Carmignac Gestion - Investment fund management company approved by the CSSF Public limited company with share capital of € 23,000,000 - RCS Luxembourg B 67 549