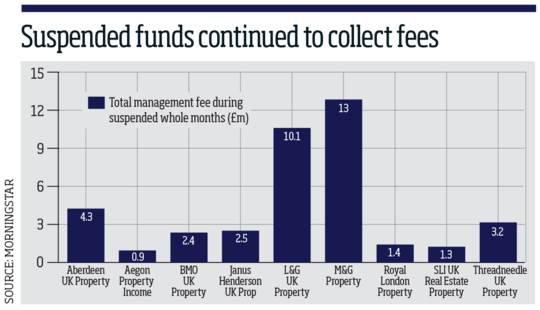

Investors stuck in the M&G Property Portfolio have forked out the most in fees

Investors trapped in suspended open-ended property funds have paid out more than £40m in management fees over the course of 2020, with some still paying fees in 2021 as £2.8bn of investor capital remains locked away across three funds.

According to Investment Week calculations utilising fee and fund size data from Morningstar Direct and share class classifications from FE fundinfo, investors have shelled out approximately £40m in management fees across nine suspended property funds over the course of 2020, with the total figure likely larger than this, as data for St James's Place, Aviva Investors and Canlife's property funds were unavailable.

The costs calculated only apply to the management fees of the fund, with various other fees such as property, transaction and dealing costs that comprise the total ongoing charge not included.

From Morningstar Direct, the fees were taken from the firm's MiFID files and total fund size was based on "surveyed figures obtained from the firm" on a month-to-month basis. Main share classes have been selected according to the methodology employed by FE fundinfo.

M&G mulls opening date for suspended property fund

Calculations have also only been made for full months of suspension, so if a fund reopened on 17 September as Columbia Threadneedle's did, data has only been collated from the five full months it was suspended (April to August).

Despite instigating a discount of 30% from the first day of its suspension, investors stuck in the M&G Property Portfolio have forked out the most in fees.

This is partly due to the size of the fund, which never fell below £2bn across the year, along with it being the only fund to be suspended for the full 12 months of 2020. It remains suspended, entering its 17th month.

While M&G's fund was suspended on 4 December 2019 as a result of "continued Brexit-related uncertainty and ongoing structural shifts in the UK retail sector" leading to "unusually high outflows", the wider sector gating was caused by the coronavirus pandemic.

On 16 March 2020, Aegon (formerly Kames) Property Income and Janus Henderson's UK Property funds were the first to pull down the shutters on investor dealing in response to the material valuation uncertainty clause (MUC) applied by its independent valuers, informing investors the Covid-19-induced pandemic had caused an inability to accurately value the UK property market.

By the end of the month, ten fund houses had suspended dealing, leaving investors unable to either buy or sell the open-ended funds for the second time in four years.

Lockdown restrictions rebuild question of 'widespread material uncertainties' in property sector

On 21 May 2020, the Royal Institution of Chartered Surveyors (RICS) announced the first signs of light for the sector, recommending that some forms of property asset were no longer subject to material uncertainty and could be valued accurately.

This lifting of the MUC continued periodically until 9 September 2020, at which point it was announced that "all UK real estate, excluding some assets valued with reference to trading potential" could now be valued accurately. This assessment was reaffirmed during both the second and third UK lockdowns, on 3 November 2020 and 5 January 2021 respectively.

From this date, property funds also began to lift their suspensions, with St James's Place reopening all its property funds on the same day, followed by Columbia Threadneedle on 17 September, Royal London Asset Management on 30 September, Legal & General Investment Management on 13 October, Aberdeen Standard Investments on 16 November and BMO Global Asset Management on 14 December.