Pictet Asset Management highlights the areas of digital offering the most compelling investment opportunities.

In the past decade, since the Pictet Digital strategy was first launched, global internet usage rate has more than doubled, smart phones have become ubiquitous, while the cost of computers and data storage has plummeted. We consider five areas of the digital world which have seen some of the biggest changes - and which offer some of the most compelling opportunities for the next 10 years and beyond.

1. Artificial Intelligence (AI)

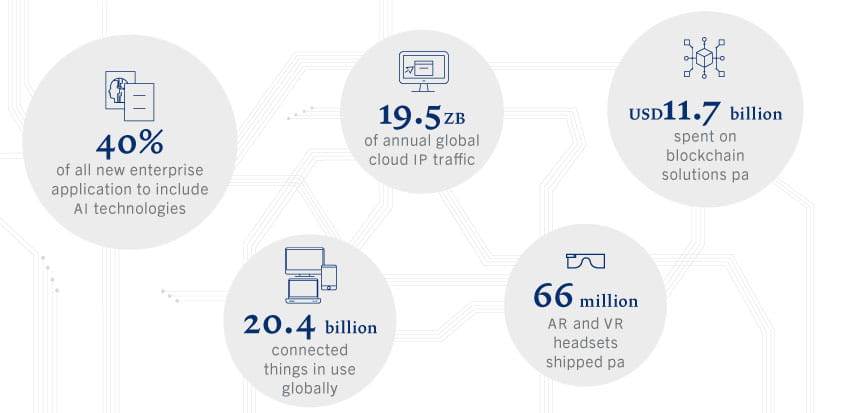

Artificial Intelligence and machine learning are seeping into virtually everything. By 2021, Gartner forecasts that 40 per cent of new enterprise applications will include AI technologies1; we believe that eventually that share will rise towards 100 per cent. Unsurprisingly, the economic impact will be huge - AI could contribute up to USD15.7 trillion to the world economy by 2030, adding 14 per cent to global GDP through increased productivity and increased consumption2.

2. Internet of Things (IoT)

Smart lightbulbs, keyless locks and healthcare monitors that can contact your doctor at the first signs of illness are just some of the billions of connected devices on the market, making our lives easier. Annual revenue in the IoTs space could exceed USD470 billion by 2020, while investment from industry expected to top USD60 trillion in the next 15 years3. To facilitate real-time response and processing for all these devices, edge computing will become the only viable option.

THE ROARING TWENTIES

By the start of the third decade of the 21st century, the digital revolution will have gained even more ground.

Sources: Gartner, IDC, Cisco. Based on forecasts for 2020-21.

3. Mobile and cloud computing

Worldwide public cloud services market revenue is forecast to nearly double in half a decade, to reach USD411billion by 20204. The fastest growing market of all cloud services categories should be the IaaS (infrastructure as a service) one, with an expected growth rate of 36.6 per cent for this year alone.

For investors, opportunities range from the largest cloud infrastructure providers - such as Amazon, Microsoft and Alibaba - to small web-based software providers.

4. Blockchain

Blockchain's potential goes far beyond volatile cryptocurrencies - including streamlining traditional banking transactions (and making them cheaper), facilitating new kinds of e-commerce marketplaces, music and video sharing sites and even eliminating the need for paper passports. We are already seeing signs of more mainstream companies - which are part of our investment universe - exploring the options.

Worldwide spending on blockchain is forecast to reach USD11.7 billion by 2022, representing a five-year compound annual growth rate (VAGR) of a whopping 73.2 per cent5.

5. Immersive experiences - AR, VR and MR

Virtual, augmented and mixed reality are changing the way we perceive and interact with the digital world. The VR and AR market is currently adolescent and fragmented, with many novelty VR applications that deliver little real business value outside of advanced entertainment, such as video games and 360-degree spherical videos. To drive real tangible business benefit, enterprises must examine specific real-life scenarios where immersive experiences can be applied to make employees more productive and enhance the design, training and visualisation processes.

[1] Gartner, "A chief data officer's guide to an AI strategy", July 2017

[2] PWC, "Sizing the price", July 2017

[3] Bain, "Brief on the Internet of Things", November 2017

[5] IDC, "Worldwide semiannual blockchain spending guide", July 2018

DISCLOSURES

This marketing material is issued by Pictet Asset Management (Europe) S.A.. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of, or domiciled or located in, any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. Only the latest version of the fund's prospectus, KIID (Key Investor Information Document), regulations, annual and semi-annual reports may be relied upon as the basis for investment decisions. These documents are available on assetmanagement.pictet or at Pictet Asset Management (Europe) S.A., 15, avenue J. F. Kennedy, L-1855 Luxembourg.

The information and data presented in this document are not to be considered as an offer or solicitation to buy, sell or subscribe to any securities or financial instruments.

Information, opinions and estimates contained in this document reflect a judgment at the original date of publication and are subject to change without notice. Pictet Asset Management (Europe) S.A. has not taken any steps to ensure that the securities referred to in this document are suitable for any particular investor and this document is not to be relied upon in substitution for the exercise of independent judgment. Tax treatment depends on the individual circumstances of each investor and may be subject to change in the future. Before making any investment decision, investors are recommended to ascertain if this investment is suitable for them in light of their financial knowledge and experience, investment goals and financial situation, or to obtain specific advice from an industry professional.

The value and income of any of the securities or financial instruments mentioned in this document may fall as well as rise and, as a consequence, investors may receive back less than originally invested. Risk factors are listed in the fund's prospectus and are not intended to be reproduced in full in this document.

Past performance is not a guarantee or a reliable indicator of future performance. Performance data does not include the commissions and fees charged at the time of subscribing for or redeeming shares. This marketing material is not intended to be a substitute for the fund's full documentation or any information which investors should obtain from their financial intermediaries acting in relation to their investment in the fund or funds mentioned in this document.

This document is a marketing communication issued by Pictet Asset Management and is not in scope for any MiFID II/MiFIR requirements specifically related to investment research. This material does not contain sufficient information to support an investment decision and it should not be relied upon by you in evaluating the merits of investing in any products or services offered or distributed by Pictet Asset Management.

This article was a paid posting by Pictet Asset Management all views and/or opinions are those of the sponsor and not of Investment Week.