Trees that kill their attackers.

It sounds like science fiction, but it's actually scientific fact.

Researchers investigating the mysterious death of hundreds of kudu in South Africa in the 1990s made a startling discovery: the antelope were killed by the acacia trees that form part of their regular diet.

It turned out that, to protect themselves from the voracious animals, the acacias flooded their leaves with lethal quantities of poisonous tannins; they also spewed ethylene gas into the air to warn nearby trees of the impending danger.

The antelopes' experiences hold important lessons for humanity. If we continue to mismanage and mistreat the world's forests, we could suffer the same fate as the kudu.

According to the UN Food and Agriculture Organization, industrialised farming and urbanisation have shrunk the world's forests by 129 million hectares in the past 25 years, an area equivalent to the size of South Africa.

The amount of carbon stored by the world's forests has consequently fallen by almost 11 gigatonnes, equivalent to about a third of the amount generated by human activities, causing a sharp rise in the concentration of planet-warming carbon dioxide (CO2) in the atmosphere.

As of May 2019, the concentration of CO2 in the air reached 415 parts per million, the highest in human history.

So, with the world struggling to limit global warming to just 1.5°C from pre-industrial levels and slash CO2 emissions by 45 per cent by 2030, our failure to use timber wisely becomes ever more absurd.

Trees can be our greatest ally in halting global warming and environmental degradation.

Not only does wood provide a cost-effective means to reduce carbon emissions, it can also restore biodiversity and improve soil quality.

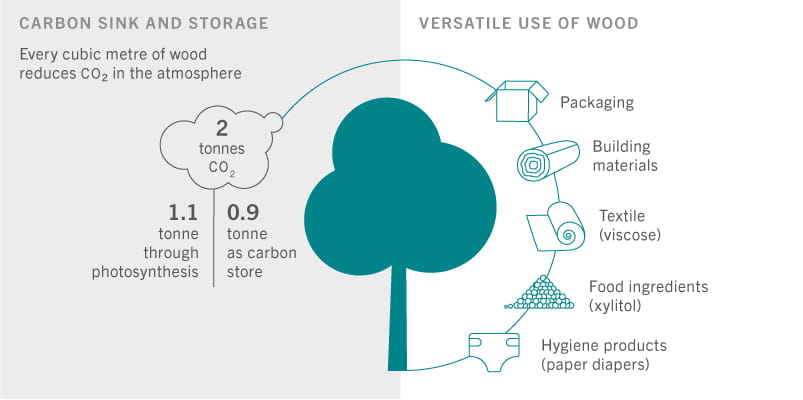

With the right technology, wood's carbon-storage properties can be harnessed across a wide range of everyday activities - including construction, textile manufacture, food packaging and food preparation.

And demand for such tech is sure to grow, not least because changing consumer tastes and tighter regulations are forcing manufacturers to cut plastics use and switch to sustainable alternatives.

This, in turn, should boost demand for sustainable wood products, creating attractive opportunities in timber-related investments.

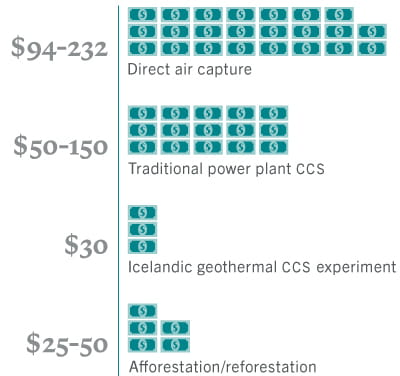

TRAPPING DIRTY AIR

Levelised cost of carbon capture, in USD, per tonne of CO2 captured

Source: University of Southampton; Nature; Richards, Kenneth & Stokes, Carrie. (2004). A Review of Forest Carbon Sequestration Cost Studies: A Dozen Years of Research. Climatic Change. 63. 1-48. 10.1023/B:CLIM.0000018503.10080.89, Ni et al. Carbon Balance Manage (2016) 11:3 DOI 10.1186/s13021-016-0044-y

400 million years of experience

In recent years, trees' carbon-capturing qualities have been overshadowed by newer, more technologically complex solutions, such as large-scale Carbon Capture and Storage (CCS) technology. CCS involves building a large-scale engineering facility to trap waste carbon from industrial power plants and store it underground.

However, this method requires a big set-up cost and can lose up to 75 per cent of carbon to leakage.

Trees, on the other hand, are cheaper to plant and have 400 million years of experience in capturing carbon. What is more, carbon does not leak out of them, unless they are burnt.

Research shows a young willow tree building up a dry biomass of 75kg in the first five years of growth captures 140kg of CO2, which compensates the emission of one car over 1,000 km.1

According to various academic studies, reforestation is among the cheapest carbon-capture methods, as well as wood burial - which involves harvesting dead or live trees and burying them underground. When used in construction, wood helps save energy over the life of a building as its thermal insulation is 15 times better than concrete and 400 times better than steel.

Every cubic metre of wood used as a substitute for steel or aluminium reduces carbon emissions to the atmosphere by an average of 0.9 tonnes.2

Even when the cost of processing and transporting wood is taken into account, its carbon footprint is negative over its entire lifecycle. A study undertaken in Germany found that the fossil fuel energy required to process and transport wood amounts to just 15 per cent of the total amount of energy that's locked within it.3

Timber's investment potential

Already a versatile renewable product, new technology is making timber even stronger, more durable and as fire-resistant as steel, boosting its credentials as an sustainable alternative to a wide variety of materials.

This has important implications for investors. Technology has turned timber into a dynamic, rapidly-growing industry that encompasses not only containerboard, paper, and pulp but also clothing, packaging, personal hygiene and real estate.

STRONG ROOTS

New technology is making timber even more versatile

Source: The European Confederation of Woodworking Industries

The growth of some timber-related industries is remarkable.

One of the fastest-growing engineered wood products is cross-laminated timber (CLT) - a building panel made of sawn, glued and layered wood.

The market for CLT is expected to expand to a USD2.3 billion globally by 2025 from the current USD670 million, an annual increase of some 15 per cent.4

But timber's renaissance doesn't stop at buildings.

Some firms are manufacturing innovative textile fibres from refined wood pulp or dissolved wood pulp to produce viscose, tencel and other substance that can be used in everything from gym outfits to fire resistant clothing.

Growing demand from emerging economies, meanwhille, fuelling a sustained expansion in the wood-based fibre market, which is expected to grow 5-6 per cent per annum between 2017 and 2022.

And new uses for wood are emerging by the day.

Take xylitol for example. The increasingly popular artificial sweetener made from refined wood fibre is set to grow into a USD1 billion by market by 2023, compared with just USD115 million five years ago.

Taking all of this into account, timber offers a compelling and diverse set of investment opportunities. It may only be a matter of time before timber becomes ubiquitous: it will be present in your clothes, the ingredients in your mid-afternoon snack, the packaging of your milk, or the buildings you live and work in — so much can be made of wood, a genuinely sustainable material.

[1] Zuercher, Bern University

[2] European Confederation of Woodworking Industries

[3] Herzog, Natterer, Schweitzer, Volz, Winter: Timber Construction Manual

[4] Transparency market research

DISCLOSURES

This marketing material is issued by Pictet Asset Management (Europe) S.A.. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of, or domiciled or located in, any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. Only the latest version of the fund's prospectus, KIID (Key Investor Information Document), regulations, annual and semi-annual reports may be relied upon as the basis for investment decisions. These documents are available on assetmanagement.pictet or at Pictet Asset Management (Europe) S.A., 15, avenue J. F. Kennedy, L-1855 Luxembourg.

The information and data presented in this document are not to be considered as an offer or solicitation to buy, sell or subscribe to any securities or financial instruments.

Information, opinions and estimates contained in this document reflect a judgment at the original date of publication and are subject to change without notice. Pictet Asset Management (Europe) S.A. has not taken any steps to ensure that the securities referred to in this document are suitable for any particular investor and this document is not to be relied upon in substitution for the exercise of independent judgment. Tax treatment depends on the individual circumstances of each investor and may be subject to change in the future. Before making any investment decision, investors are recommended to ascertain if this investment is suitable for them in light of their financial knowledge and experience, investment goals and financial situation, or to obtain specific advice from an industry professional.

The value and income of any of the securities or financial instruments mentioned in this document may fall as well as rise and, as a consequence, investors may receive back less than originally invested. Risk factors are listed in the fund's prospectus and are not intended to be reproduced in full in this document.

Past performance is not a guarantee or a reliable indicator of future performance. Performance data does not include the commissions and fees charged at the time of subscribing for or redeeming shares. This marketing material is not intended to be a substitute for the fund's full documentation or any information which investors should obtain from their financial intermediaries acting in relation to their investment in the fund or funds mentioned in this document.

This document is a marketing communication issued by Pictet Asset Management and is not in scope for any MiFID II/MiFIR requirements specifically related to investment research. This material does not contain sufficient information to support an investment decision and it should not be relied upon by you in evaluating the merits of investing in any products or services offered or distributed by Pictet Asset Management.

This article was a paid posting by Pictet Asset Management all views and/or opinions are those of the sponsor and not of Investment Week.