The reform comes as the government has been looking for a way to consolidate schemes and solve the challenge of small pots.

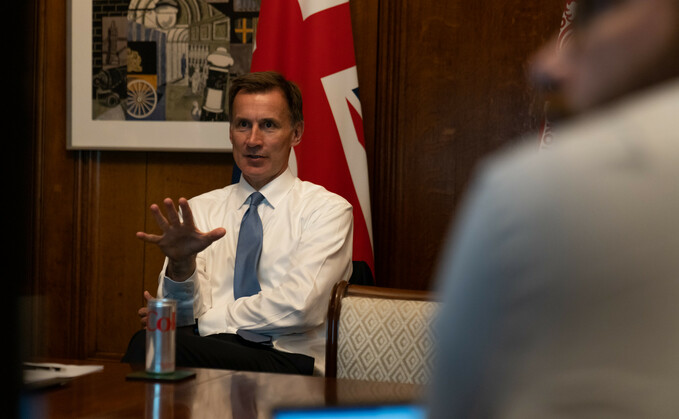

Chancellor Jeremy Hunt is set to unveil “pot for life” reforms that will give workers the right to nominate the pension scheme their employers pay contributions to.

The measures - reported by the Financial Times and expected to be included in tomorrow's Autumn Statement - will be similar to the approach taken by countries such as Australia.

The FT quoted a HM Treasury insider as saying: "Helping people keep the same pension pot will stop billions of pounds being needlessly lost and make sure tomorrow's pensioners benefit from every penny they save."

At present, employers are obliged to automatically enrol eligible new staff into a retirement scheme chosen by the company - a requirement that has resulted in millions of small pots building up in the system as workers move jobs and switch to a new employer's scheme.

This comes after the government issued a call for evidence on addressing the challenge of deferred small pots in July - focussing on two large-scale automated consolidation solutions - a default consolidator model and pot follows member.

Pensions notably excluded from King's Speech

At the time, the Department for Work and Pensions said it wanted to deepen the evidence base around the scale and characteristics of the growth in the number of deferred small pots.

Introducing the call for evidence, the then pensions minister Laura Trott said: "The growth of small pots means there is undue cost and inefficiency in the pension system.

"It creates a risk that deferred members lose track of their workplace pension savings - acting as a disincentive to member engagement. And it creates a cross subsidy risk for members with larger pots, which may impact their retirement outcomes."

Trott added: "We will assess the evidence to identify and develop an approach which puts the interests of members first by facilitating easy consolidation of deferred pensions, mindful that the approach needs to work for the whole of the auto-enrolment (AE) market.

"We will consider the shape and approach of legislation required, build a cost/benefit analysis, and consider the impact on the market of the potential solutions to inform our thinking."

Benefits and complications

Under the pot follows member solutions, when an employee moves jobs their deferred pension pot in their former employer's scheme would automatically move with them to their new employer's scheme, if it meets the chosen eligibility criteria for automatic consolidation.

Individuals would have the opportunity to opt-out and leave any / all deferred pots where they are.

In its June 2022 report, the Small Pots Cross-Industry Co-ordination Group concluded that a correctly designed pot follows member model is likely to resolve much of the small pots issue - noting that an advantage of this solution is that it builds on the existing system, rather than require the creation of new consolidator entities.

Pension companies to announce 5% commitment to growth assets

However, it also said there were situations where this model could create significant complications with a negative impact on employers, members and providers.

It said one example of this concerns the position of multiple job holders who have two or more active pots - noting that, in March 2017, there were approximately 1.1 million multiple jobholders, of which 72% aged between 22 and state pension age were eligible for AE in all or at least one of their jobs.

Similarly, the Small Pots Cross-Industry Co-ordination Group noted concerns about members who move jobs frequently and whose deferred pots may never in practice catch up with them.