CT Responsible Global Equity Fund

Our CT Responsible Global Equity Fund adopted its global remit in 1998. At the time it was among the first, but responsible investment has since seen rapid development, especially in recent years, with environmental, social and governance (ESG) orientated investment funds moving from esoteric to mainstream options.

The last two-and-a-half decades have seen significant shifts in the awareness of sustainability-related issues and throughout this period the fund has continued to evolve - transitioning our approach to ensure we remain to the fore of developments with a modern sustainability-orientated global equity portfolio.

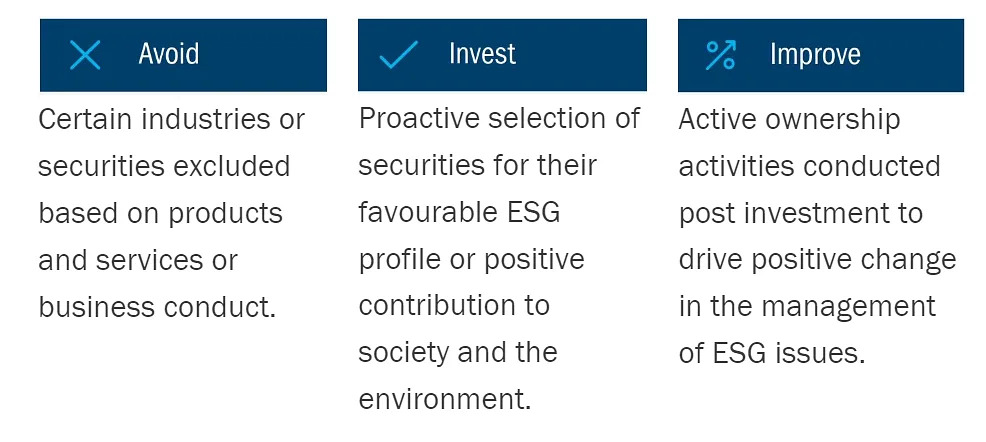

Applying a clear philosophy

Our ‘avoid, invest, improve' investment philosophy has been a constant over the years, although the emphasis has shifted over time. ‘Avoid' was a primary focus in the early days with exclusion criteria designed to align our strategy with investors looking to avoid investment in areas doing harm through the application of negative screens. We have applied exclusions since launch and the criteria have continued to be refined as debates evolve and new challenges emerge. Our responsible investment team own the exclusionary criteria with oversight from an external Responsible Investment Advisory Council.

Figure 1: A clear philosophy

Invest - embracing the positive

The avoidance of harm remains critical - you won't find weapons manufacturers, firms involved in fossil fuel production or alcohol in our portfolio. But with issues such as climate change climbing up the global agenda, we have been keen to embrace the positive by increasingly investing in companies making a positive contribution to the environment and/or society. There are multiple sustainability themes at play in today's world and we have identified seven within which to focus our research efforts.

An increasing emphasis on sustainability themes

The last decade has seen the portfolio increasingly orientated around our seven sustainability themes. It's a shift that's entirely aligned with broader recognition of sustainability-orientated challenges and the emergence of a raft of related investment opportunities in well placed pioneering businesses.

Figure 2: 'Invest' - Sustainability themes over time

Source: Columbia Threadneedle Investments. Factsheet From 31 December 2012 - 30 December 2022

Hardwiring sustainability into the portfolio

Our view is that innovative, well-managed and strongly positioned businesses within our seven themes look set to enjoy long-term structural tailwinds. The next steps are pinpointing sustainable companies, or those that actively support sustainability, and using fundamental analysis to assess businesses against our quality criteria. For the former we use our proprietary assessment of a company's sustainability profile - the Additionality, Intentionality & Materiality (A.I.M) framework.

In short, we want to see the innovation required to tackle a sustainability challenge, evidence that management is orientating the business around sustainability, and a clear linkage between sustainability and revenue. Alongside an analysis of A.I.M we also consider a company's contribution to the UN Sustainable Development Goals (SDGs) - a widely adopted route map to a more sustainable world. If a company clears our sustainability hurdle it is then subject to deep fundamental analysis to ascertain its business model, competitive advantage and management, as well as a robust assessment of value.

Risk Disclaimer

Views and opinions have been arrived at by Columbia Threadneedle Investments and should not be considered to be a recommendation or solicitation to buy or sell any companies that may be mentioned.

The information, opinions, estimates or forecasts contained in this document were obtained from sources reasonably believed to be reliable and are subject to change at any time.

Engagement efforts outlined in this Viewpoint reflect the assets of a group of legal entities whose parent company is Columbia Threadneedle Investments UK International Limited and that formerly traded as BMO Global Asset Management EMEA. These entities are now part of Columbia Threadneedle Investments which is the asset management business of Ameriprise Financial, Inc. Engagement and voting services are also executed on behalf of reo® clients.