A new study from Schroders has found investors care more about the environment than ever

Investors are more focused on climate change when deciding their portfolios than ever before, a new study from Schroders has found.

Schroders Global Investors Study, which surveyed 23,950 investors from 33 locations globally, has found that sustainability is moving up the agenda post-pandemic, with 55% of investors now placing greater importance on environmental issues.

57% of respondents reported that they would feel positive about moving to an entirely sustainable portfolio assuming the same level of risk and diversification, with younger people (60%) particularly keen.

Respondents also increasingly expect action from a wide range of actors to fight climate change. 74% of investors said that national governments and regulators are responsible for mitigating climate change, up from 70% last year. 68% of respondents said that companies themselves also bore responsibility in addressing climate solutions, from 63% last year.

However, the largest change in views came in whether investment managers and major shareholders should be responsible for mitigating climate change, with 53% of respondents agreeing compared to 46% last year.

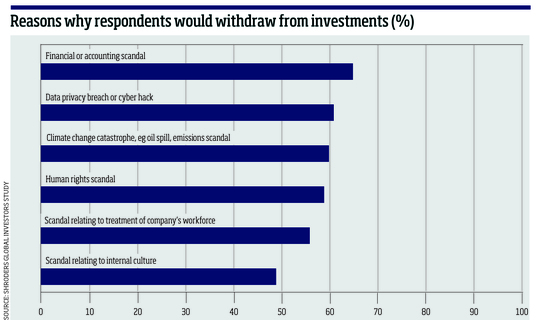

The survey also explored the reasons why investors would divest from a fund.

People identifying as ‘expert or advanced' were more likely to divest in most cases, but in the case of data breaches, all expertise groups were equally likely to divest at 61%.

The reasons why people are attracted to sustainable funds has also changed since 2020, with 52% saying they are attracted due to the wider environmental impact compared to 47% last year, and 39% saying it was due to their societal principles, up from 32% last year.

However, over half of respondents feel that they still need data or evidence showing investing sustainably delivers better returns to encourage them to increase their sustainable investments. A further 40% of investors said that regular reporting showing the impact of their investments on society and the planet would increase their sustainable investments, with 36% adding that self-certification from the provider of the investment would encourage them.