Key Insights

- The health of the U.S. economy appears to have played an important role in whether the incumbent party retained the presidency in an election year.

- In turn, whether the incumbent party won the White House seemed to influence trends in market volatility before and after past elections.

- We believe that investment decisions should be based on longer‑term fundamentals, not near‑term political outcomes.

The U.S. presidential election cycle is ramping up. So is media coverage and a barrage of political advertising.

The contest between Democrat Joe Biden and Republican Donald Trump—and its implications—looms large in the minds of investors both in the U.S. and abroad.

Let's explore the historical relationship between U.S. presidential elections and the performance of the broader U.S. equity market.

Correlations exist in varying degrees, but clients should focus on what ultimately matters over the longer term: the economy and business fundamentals.

Know the data's limits

The market performance data used in this study go all the way back to 1927. However, only 24 presidential elections have occurred over this period, so it's difficult to draw statistically significant conclusions about how those elections impacted stock market returns.

Moreover, we would caution against focusing on a single variable that ignores the many other factors that historically have driven market returns.

Some of the elections in our sample occurred in years when major economic developments—not the elections themselves—had an outsized influence on equity markets.

Examples include the Great Depression (1932), World War II (1940 and 1944), the bursting of the technology bubble (2000), the global financial crisis (2008), and the COVID‑19 pandemic (2020).

Has the timing of U.S. presidential elections mattered for stock market returns?

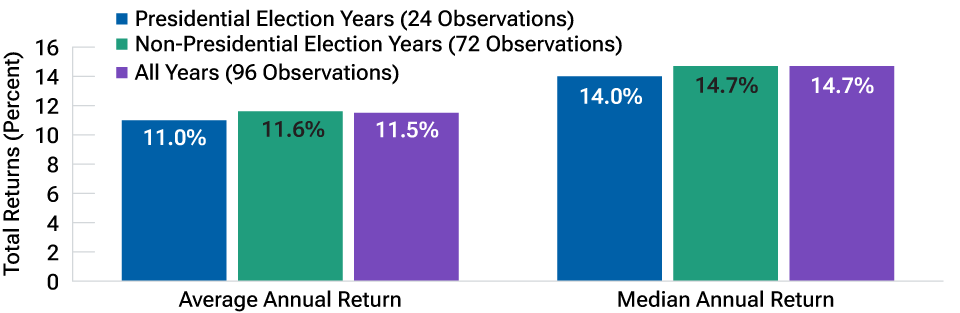

Average and median total returns for the S&P 500 Index were modestly lower in presidential election years compared with both non‑election years and with the long‑term average for the past 96 years of market performance (Figure 1).

S&P 500 has posted lower total returns in presidential election years

(Fig. 1) Average and median calendar year returns

December 31, 1927, to December 31, 2023.

Past performance is not a reliable indicator of future performance.

Source: T. Rowe Price analysis of data from Bloomberg Finance L.P. See Additional Disclosure.

Total returns include gross dividends. We use average and median average annual returns to see if an outlier data point might be skewing the results. Conclusions are stronger when the average and median returns are either both positive or both negative.

Important Information

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources' accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date written and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request.

It is not intended for distribution to retail investors in any jurisdiction.