Rebecca McVittie, Investment Director, Fidelity International

Global equity markets don't stand still

Global equities have traditionally served as a vehicle for diversification and forward-looking opportunities, enabling investors to capture differentiated growth across markets, sectors and styles. However, rising allocations to passive vehicles and greater index concentration mean that investors are increasingly exposed to more correlated and potentially less forward-looking assets.

Of course, periods of concentrated market leadership are not unique and include, for example, the ‘Tech Bubble' of the late 1990s or the China-driven commodity super cycle from 2009 to 2011. However, accurately forecasting turning points in the market is near impossible, as several forces converge unpredictably.

Figure 1: The shifting market leadership landscape

Largest companies by capitalisation over time

Source: Fidelity International, LSEG, MSCI ACWI data as at 30 November 2025.

By contrast, the disciplined work of fundamental, bottom-up equity investing seeks to understand business models, competitive advantages and management quality - an approach that can be pursued with far greater reliability. It also provides scope to engage with management teams, encouraging behaviours and decisions that support long-term value creation. Over time, we believe this combination can deliver more consistent outcomes than any attempt to call market cycles.

Harnessing breadth to bring balance and stability

The global universe offers access to an array of companies of all sizes, industries and geographies. However, diversification is not only about spreading risk, it's also about broadening opportunity. Economic cycles, corporate governance standards and innovation trends vary across markets, creating a wider and more diverse set of performance drivers.

The global investor can express conviction where change is creating opportunity. For example, though corporate reform and improving governance in Japan, fiscal and structural renewal in Europe, and the broad adoption of AI transforming industries worldwide.

The flexibility to allocate across markets allows global investors to be both more active and potentially less volatile. With a broad opportunity set we can achieve higher active share through genuine stock selection, and avoid concentration through diversification across regions.

The freedom to explore ideas across the market cap spectrum, in areas less researched by market participants, also brings benefits. Primarily by reducing concentration further and providing access to innovative businesses with attractive growth profiles - the ‘winners of tomorrow'.

Capturing opportunities in different cycles

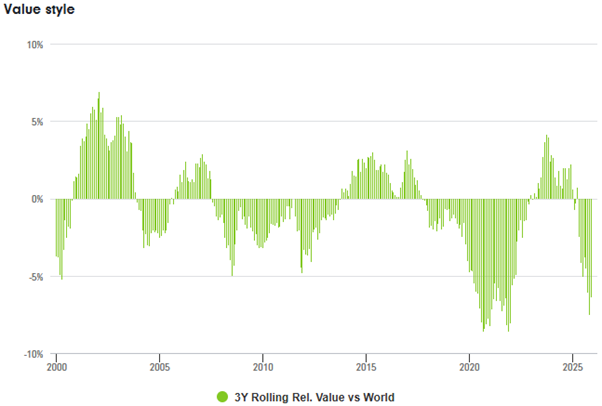

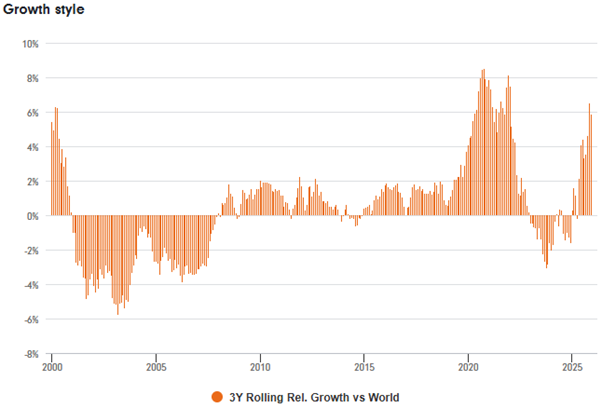

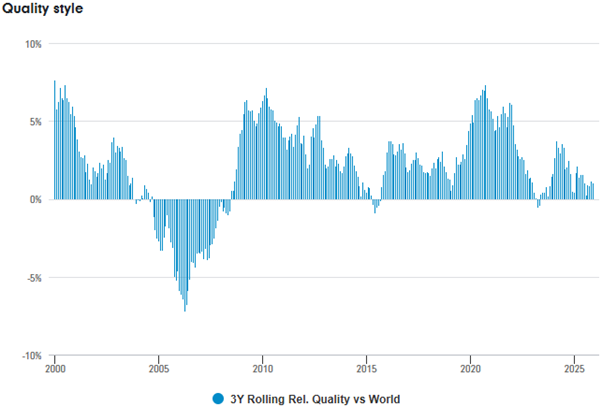

Different investment styles lead at different times. Growth companies often outperform in periods of low inflation and abundant liquidity, while value and cyclicals tend to lead when economies re-accelerate. Quality businesses can offer stability, compounding over the long term and providing resilience during periods of uncertainty. However, styles do not move in tandem over time - value, quality and growth move through their own cycles, rather than rising and falling together.

Figure 1: Performance of value, growth and quality over time

Past performance does not predict future returns.

Source: Fidelity International, LSEG DataStream, 30 November 2025. MSCI Total Return Indices in USD terms have been used. Annualised 3-year rolling returns. Charts depict Value vs. World, Growth vs. World, Quality vs. World.

Our strategies focus on diversifying across investment styles, leaving us less exposed when market or style leadership rotates, while acknowledging that within a global context, varying styles may lead across different regions. Taking advantage of this has the potential to smooth the path of returns and allows us to avoid dependence on any single factor.

Of course, when powerful trends take hold and narrow market leadership reaches extreme levels, delivering outperformance can be challenging. However, while this concentration has rewarded investors handsomely during periods of market strength, it introduces fragility when sentiment turns.

A diversified strategy can reduce this risk by balancing innovative, high-growth companies with recovery stories, stable cash-flow generators, and underappreciated value. In essence, diversification can support resilience, offering participation in upside with careful consideration to downside risks.

Diversification across timeframes

We also seek diversification across time horizons. Value opportunities may have shorter holding periods, as the investment thesis often depends on the company demonstrating progress through restructuring, capital discipline or improved profitability. Once this is reflected in the share price, the opportunity typically normalises.

Certain growth companies with exceptional long-term potential may not deliver returns in a straight line. Share prices can rise and fall based on new information or changing market conditions. Investors who are comfortable with near-term fluctuations are therefore able to pursue strong long-term compounding outcomes.

We believe this ability to blend shorter-term catalysts with long-term compounders can provide a more balanced return profile through varying market conditions. Furthermore, unlike passive investors, who remain committed to a stock through index adherence, we can control our holding periods. If a company underperforms or diverges from expectations, we can act decisively by selling out and reallocating capital to more promising opportunities.

Balancing correlation and conviction

Diversification is not simply about owning more stocks - it involves understanding correlations so that performance stems from genuine stock selection, rather than shared exposures. By being considerate to how holdings behave relative to one another, we can target portfolio return drivers that are distinct and complementary.

A global remit amplifies this advantage. When an attractive theme is identified, we can pursue the best expression of that idea anywhere in the world, regardless of geography or index membership. Many of today's most powerful investment themes cut across borders. A global approach provides access to the full ecosystem of beneficiaries, not just those domiciled in one market, and the ability to balance cyclical and structural exposures across regions.

For example, as the rise of AI has unfolded, we have been able to harness opportunities beyond the confines of the US, investing wherever innovation is supported, and R&D is flourishing. Similarly, recognising that themes can have broad applications and be expressed in different ways, we can consider the increasingly important role that AI adopters play versus enablers.

Elsewhere, the healthcare sector is exceptionally diverse. Many areas are less exposed to policy changes, yet businesses across the sector have lagged broader markets due to policy rhetoric and pricing reform fears, leaving parts of the sector unloved and ripe for selective investment.

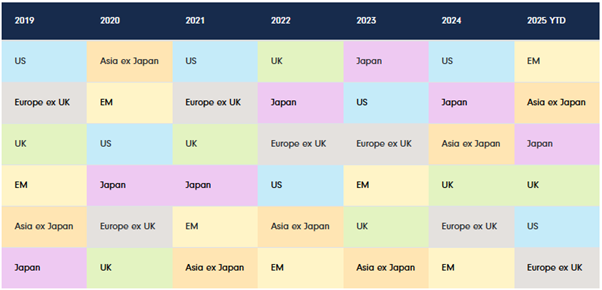

As active global investors, we are not forced into narrow pockets of the market. The ability to selectively seek out opportunities facilitates diversification, without compromising conviction. We recognise and can capitalise on the fact that each region is nuanced - and that no single market is continuously the ‘winner'.

Figure 2: Varied regional market leadership highlights that markets are dynamic

Past performance does not predict future results.

Source: FTSE, LSEG DataStream, JP Morgan. Performance ranking runs from top to bottom for each distinct period. Ranking is based on US = S&P 500 Index, Europe ex UK = MSCI Europe Index, UK = FTSE All Share Index, Japan = TOPIX, Asia ex Japan = MSCI Asia ex Japan Index. All observations are based on total return in local currency, except for MSCI Asia ex-Japan and MSCI EM, which are in US dollars. Data as of 30 November 2025.

At the same time, we can use position sizing to express varying levels of conviction efficiently. We can make larger allocations to high-conviction ideas, and hold smaller, diversified positions (or baskets of stocks) in areas where innovation can drive impressive growth, but volatility is potentially much higher.

Building resilience in an uncertain world

In an environment where risks are numerous, pronounced and often emerge without warning, a portfolio that is not beholden to any single source of risk can help to ensure that no individual event or market shift can disproportionately impact performance.

By combining aspects such as style diversification, geographic breadth and time-horizon flexibility, our portfolios are able to:

- Access the full global equity universe on a selective basis

- Capture opportunities as the market rotates

- Avoid concentration and address a broad range of risks

- Maintain resilience in the face of uncertainty and unexpected shocks

Diversification is not a compromise - it is the foundation for consistent, forward-looking investing in an unpredictable world.

Learn more about the Fidelity Global Special Situations Fund

Important information

This is for Investment Professionals only and should not be relied upon by private investors. The value of investments can go down as well as up so you may get back less than you invest. The value of investments in overseas markets can be affected by changes in currency exchange rates. Investments in emerging markets can be more volatile than other more developed markets. Investors should note that the views expressed may no longer be current and may have already been acted upon. Issued by FIL Pensions Management, authorised and regulated by the Financial Conduct Authority. Fidelity International, the Fidelity International logo and F symbol are trademarks of FIL Limited. GCT251218EUR