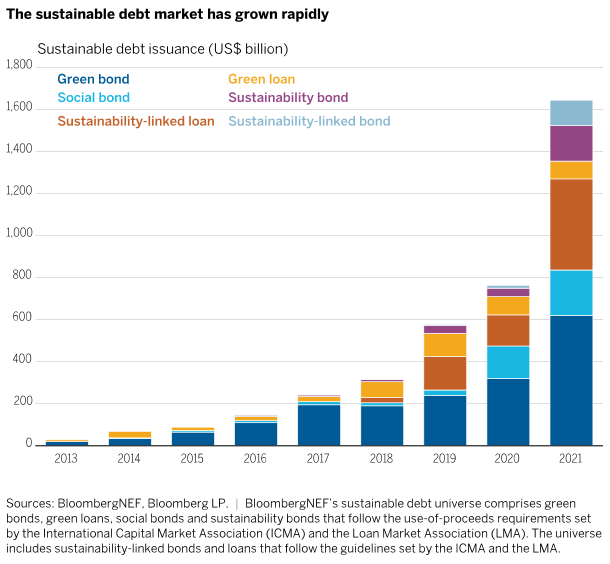

The sustainable debt market is growing rapidly as issuers face increased pressure from investors and regulators to finance a more sustainable future. In 2021, sustainable debt issuance doubled to over US$1 trillion, and it is predicted to exceed that figure in 2022 despite an expected decrease in overall primary supply. Green bonds remain the most common product within the labelled bond universe and are forecast to account for 52% of the total sustainable bond supply in 2022, while sustainability-linked bonds (SLBs) are the fastest-growing segment.1

We explore the importance of establishing a robust framework to assess suitability of labelled issuance for our portfolios and highlight how we can use our engagement edge to combat greenwashing.

Labelled bonds at a glance

Use of proceeds bonds

With their key performance indicators (KPIs) and use of proceeds (UoP) outlined at issuance, green, social and sustainable bonds allow investors to target social and environmental objectives through their fixed income allocations, complementing traditional fixed income securities within an impact portfolio.

We have also identified some secondary benefits which we feel further enhance the appeal of UoP bonds:

- Transparency: after issuance of green, social or sustainable debt, issuers report on the exact projects to which proceeds were allocated, the amounts, the impact and achievement (or not) of targets. This helps us to verify, measure and report on the impact our investments have.

- Downside protection: in some periods of volatility, UoP bonds have not sold off as quickly as their non-green counterparts. While this may lead to a pronounced "greenium" in the secondary market, it highlights the potential for green bonds to exhibit stickier characteristics and offer more stable returns in periods of market stress.

Sustainability-linked bonds

SLBs allow issuers to raise finance without ring-fencing the proceeds for a social or environmental project. Instead, they tie the future coupon payment to a sustainability performance target (SPT) which measures improvements in the borrower's sustainability profile — for example, an overall reduction in greenhouse gas emissions associated with products manufactured. Some issuers have faced criticism for SLBs that lack robustness or incentive to allocate the proceeds with sustainable objectives in mind.

Nevertheless, we see a place for robust SLBs within our portfolios. We have identified some secondary characteristics enhancing their appeal:

- Accountability: SLBs offer an alternative mechanism for companies to prove their commitment to sustainability. With coupon payments tied to the achievement of a target, SLBs impose a direct financial penalty on the issuer if their target is not met.

- Flexibility: SLBs give issuers greater flexibility than UoP bonds. They allow more types of issuers — including those whose products/services don't have a direct social or environmental impact — to enter the sustainable debt market and thereby facilitate a larger collective effort toward increasing the sustainability of more issuers' operations.

Building a framework

We recognise that labelled bonds are a useful part of the public debt market toolkit in the pursuit of generating impact. We have developed a labelled bond framework which aims to ensure we stay true to our commitment to high integrity impact investing and combatting greenwashing. Below, we outline our best practices:

UoP bonds

- Threshold for use of proceeds

Without standardisation in the labelled bond market, the percentage of proceeds adjusted towards social or environmental projects will vary. To maximise the materiality of our investments, we favour bonds where over 90% of the proceeds are to be allocated to eligible projects.

- Lookback period

Some UoP bonds are issued to refinance an existing or historical project. While we accept some exposure to refinancing for long-term projects, we typically have a maximum lookback period of two years. This ensures our financing is tilted towards new projects.

- Sustainability of operations

Some sectors are excluded from our investable universe, as we believe they are fundamentally misaligned with our impact objectives; we will not invest in ‘use of proceeds' issuance from issuers in these sectors. Where an issuer's business model does not qualify for impact, but we approve at the security level, we consider the sustainability of their operations/business practices in our investment process.

- Valuation

Once we have determined whether a bond is eligible for our investment universe, fundamental analysis ensures that the bond is suitable according to the risk and return targets of our portfolios.

Sustainability-linked bonds

SLBs' more flexible structure, combined with a lack of regulation, creates opportunities for greenwashing. We pay close attention to SLBs' structure to ensure that the issuance aligns with our high-integrity approach to impact investing:

- Sustainability performance targets

We favour issuers with ambitious SPTs and meaningful financial penalties for missing future goals — for example, via a coupon step-up. We avoid issuers which set targets that are in line with what the issuers were planning to achieve through their ordinary business activities or have minimal penalties, such as a step-up that is small or implemented late in the coupon payment cycle. - Consistent KPIs

We favour issuers which use consistent KPIs to monitor progress towards an SPT. We feel issuers should report historical KPI levels, use consistent base rates and be held accountable through engagement and potentially divestment if their KPI reference changes. - Sustainability of operations

As with UoP bonds, we will not invest in SLBs from issuers in sectors which are misaligned with our impact objectives. - Valuation

As with UoP bonds, it's critical to assess financial characteristics to determine suitability according to portfolio risk and return targets.

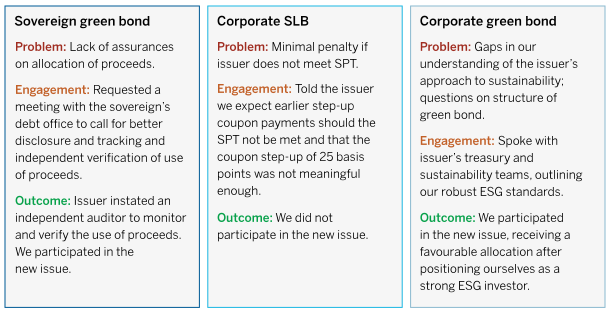

Our engagement edge

Our labelled bond framework is complemented by Wellington's Fixed Income Syndicate Trading desk, which benefits from its relationships with the sell side. Through our engagement, we highlight structural deficiencies in labelled bond offerings to be communicated to the issuers through their advisors. We also meet the issuer during the pre-marketing phase of a future deal and advise how to robustly structure a sustainable bond. Engaging in dynamic discussions both on the structure of sustainable debt issuance and on specific ESG-related questions allows us to develop a fuller understanding of the issuer's approach to sustainability and identify whether it is serious about working towards its sustainability goals.

Conclusion

We expect the labelled bond market to keep growing rapidly, given the nascent stage of the sustainable debt market, the continuing establishment of carbon reduction commitments by corporations and governments and increased demand from investors. This evolution will pose challenges for investors using an ESG or impact lens.

While regulation in the labelled bond market is currently lacking, we expect the proposed European Green Bond Standard — if implemented — to increase the transparency and robustness of green issues. This may lead to a new gold standard for green bonds, pressuring issuers to obtain the label. The same principles could also be used to develop a social and sustainable bond standard, leading to greater uniformity across sustainable debt issuance. Conversely, the European Green Bond Standard could reduce the appeal of existing green bonds which don't meet the proposed standard. This could create a "haves versus have-nots" pricing dynamic, incentivise stronger, more ambitious terms and support the transition to a sustainable future.

Irrespective of regulation, we believe that it is essential for responsible asset owners to have a robust framework for analysing labelled issuance and that this will ultimately help to establish more robust ESG standards in the market and increase the likelihood of generating real world impact.

This post is funded by Wellington Management

Footnote

1 Data source: Crédit Agricole |

In the UK, issued Wellington Management International Limited (WMIL), a firm authorised and regulated by the Financial Conduct Authority (Reference number: 208573). In Europe (ex. UK and Switzerland), issued by Wellington Management Europe GmbH which is authorised and regulated by the German Federal Financial Supervisory Authority (BaFin).

©2022 Wellington Management. All rights reserved. As of 1 August 2021.

Disclaimer

For professional, institutional and accredited investors only. Capital at risk. The views expressed are those of the authors and are subject to change. Other teams may hold different views and make different investment decisions. This material and its contents are current at the time of writing and may not be reproduced or distributed in whole or in part, for any purpose, without the express written consent of Wellington Management. While any third-party data used is considered reliable, its accuracy is not guaranteed. This commentary is provided for informational purposes only and should not be viewed as a current or past recommendation and is not intended to constitute investment advice or an offer to sell or the solicitation of an offer to purchase shares or other securities. Holdings vary and there is no guarantee that a portfolio has held or will continue hold any of the securities listed. Wellington assumes no duty to update any information in this material in the event that such information changes.