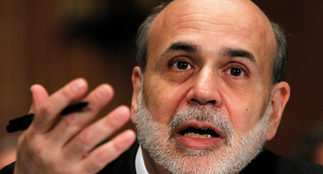

The Federal Reserve appears set on keeping interest rates high for the next few months, as it continues its efforts to push US inflation back towards its 2% target.

Minutes from the Fed's last monetary policy decision meeting released on Tuesday (21 November) showed no indication that rates would either be hiked or cut in the near future, instead arguing it was "critical that the stance of monetary policy be kept sufficiently restrictive". "Participants noted that inflation had moderated over the past year but stressed that current inflation remained unacceptably high and well above the committee's longer-run goal of 2%," the minutes said. "They also stressed that further evidence would be required for them to be confident that inflation was clea...

To continue reading this article...

Join Investment Week for free

- Unlimited access to real-time news, analysis and opinion from the investment industry, including the Sustainable Hub covering fund news from the ESG space

- Get ahead of regulatory and technological changes affecting fund management

- Important and breaking news stories selected by the editors delivered straight to your inbox each day

- Weekly members-only newsletter with exclusive opinion pieces from leading industry experts

- Be the first to hear about our extensive events schedule and awards programmes