Marketing Material

Beijing's decision to drop its draconian zero-Covid policy and instead push for growth is a boon for luxury goods producers. Although they've weathered China's recent turmoil reasonably well, the government's policy shift is bound to release pent-up demand.

The top end of the Chinese luxury market has been resilient throughout, but even where demand has been dented within China, wealthy Chinese have continued to buy such goods abroad, which has helped many brands to sustain global sales. At the same time, Chinese consumers are starting to take an interest in niche sporting and educational products and services - from kayaking to painting lessons - while also increasingly shifting their focus to domestic premium brands, according to Pictet's Premium Brands Advisory Board. Leading premium brands producers still expect China to be the world's top luxury market by 2025.1

To be sure, the near-term remains a challenge: a combination of inhospitable politics, residual economic headwinds and a shift in consumer tastes are all hurdles for luxury goods producers, warns the advisory board. So while the Chinese personal goods market saw 36 per cent growth in 2021 over the previous year,2 2022 was distinctly less favourable.

The recent Communist Party Congress reinforced President Xi Jinping push to increase state control, which threatens to further undermine China's dynamic private sector. At the same time, Xi's zero-Covid policy had a major impact on the economy, with up to half of the country's regions affected, leaving travel - both internal and foreign - heavily curtailed. Demand was further depressed by the property crisis - real estate represents some 70 per cent of household assets in China. Official crackdowns on some industries, like private education and internet commerce, has also had significant effects, forcing large firms to cut jobs. More generally, youth unemployment has risen to 20 per cent.

Releasing pent-up demand

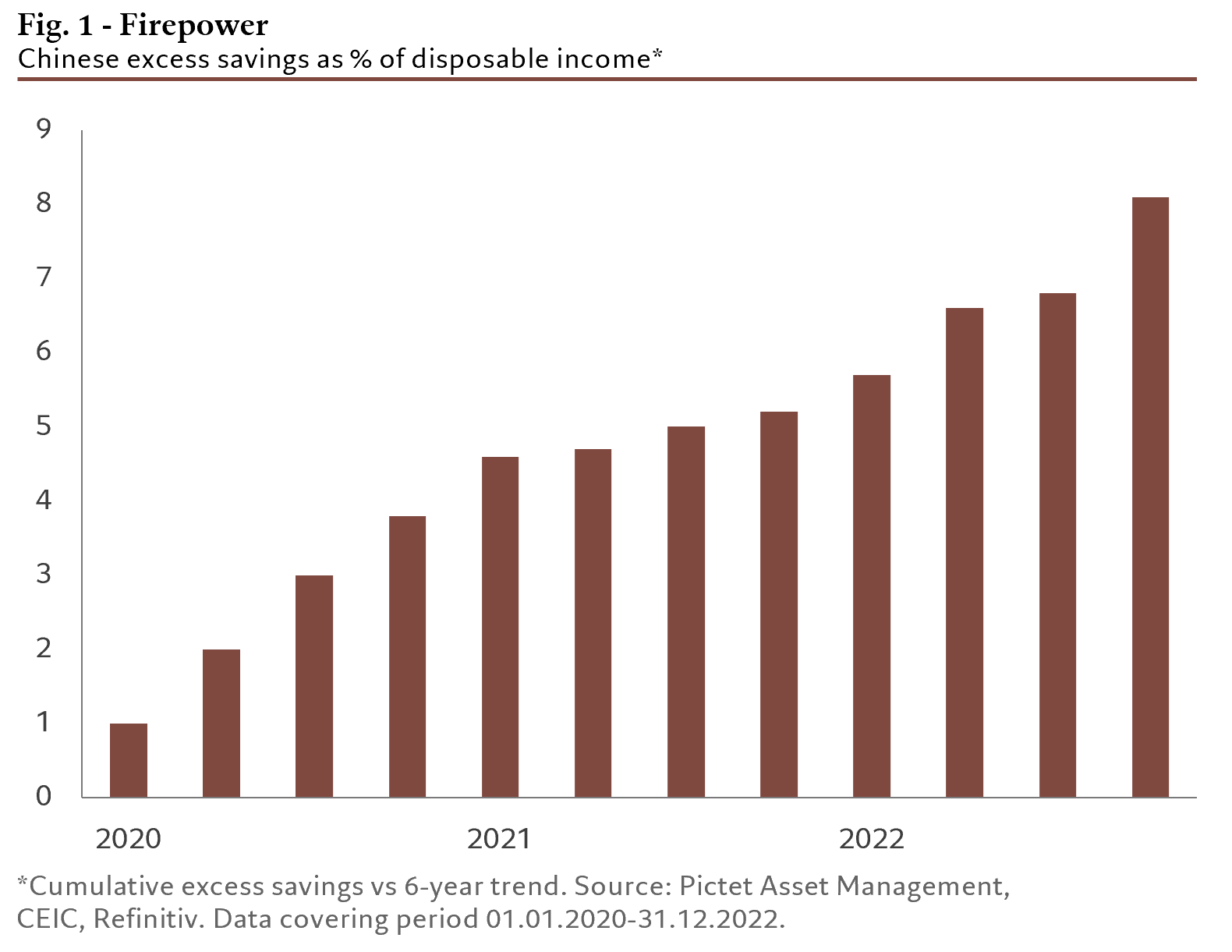

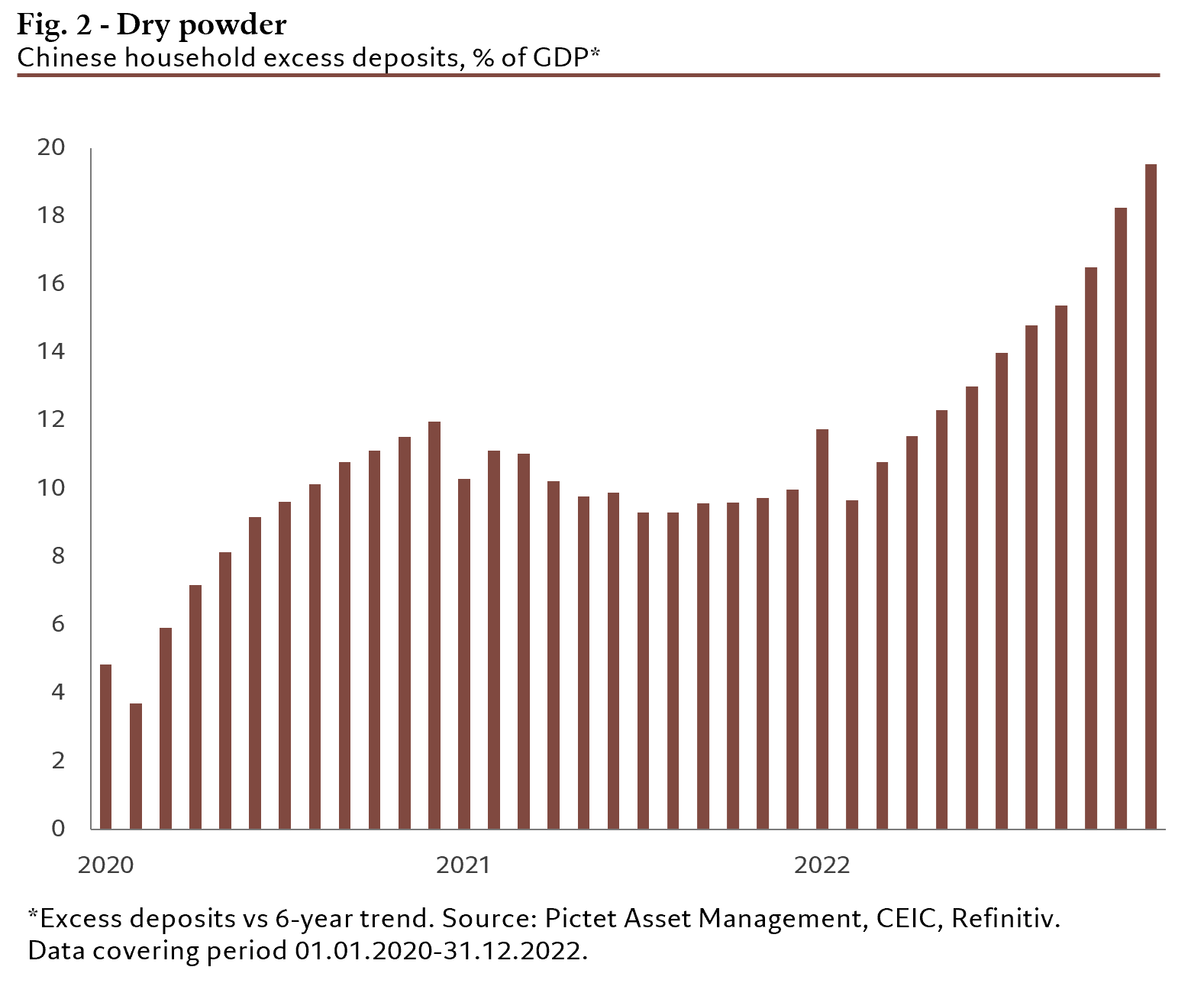

But with the government dropping its zero Covid policy and introducing measures to support the country's struggling property market, China is poised to boom over the coming year - Pictet Asset Management's strategists expect China to outperform developed economies during the coming year. Our economists estimate that, by the end of 2022, Chinese cumulative excess savings accounted for some 8.1 per cent of disposable income and household excess savings nearly 20 per cent of GDP (see Figs. 1 and 2).

This should help support Chinese retail consumption and, with it, spending on luxury goods. Forecasters still expect China to become the world's biggest market for luxury goods by 2025. Mere moderation of the zero-Covid policy or signs that the pandemic is no longer a health crisis could release some pent-up demand, potentially boosting global turnover in the sector by 10 per cent. Chinese luxury brands rooted in local culture, such as traditional medicine and craftsmanship will be in particular demand and are likely to be supported by Beijing.3

Overall, the glass remains half full for luxury goods companies selling into the Chinese market. A few of the very high-end brands even managed to generate growth in sales during the difficult conditions of the third quarter of 2022. Chinese appetite for luxuries will endure. Even though the across-the-board boom of the past decade seems unlikely to be repeated, the picture remains brighter for top brands and niche suppliers of both goods and services.

[1] https://www.scmp.com/lifestyle/fashion-beauty/article/3164527/china-be-biggest-luxury-market-2025-say-consultants-after?module=inline&pgtype=article

[2] https://www.assemblyglobal.com/reports/china-luxe-report-2022

[3] https://daxueconsulting.com/chinese-luxury-brands-report/

This article is funded by Pictet Asset Management

Disclaimer

This material is for distribution to professional investors only. However, it is not intended for distribution to any person or entity who is a citizen or resident of any locality, state, country or other jurisdiction where such distribution, publication, or use would be contrary to law or regulation. The information and data presented in this document are not to be considered as an offer or solicitation to buy, sell or subscribe to any securities or financial instruments or services. Information used in the preparation of this document is based upon sources believed to be reliable, but no representation or warranty is given as to the accuracy or completeness of those sources. Any opinion, estimate or forecast may be changed at any time without prior warning. Investors should read the prospectus or offering memorandum before investing in any Pictet managed funds. Tax treatment depends on the individual circumstances of each investor and may be subject to change in the future. Past performance is not a guide to future performance. The value of investments and the income from them can fall as well as rise and is not guaranteed. You may not get back the amount originally invested.

This document has been issued in Switzerland by Pictet Asset Management SA and in the rest of the world by Pictet Asset Management (Europe) SA, and may not be reproduced or distributed, either in part or in full, without their prior authorisation.

For UK investors, the Pictet and Pictet Total Return umbrellas are domiciled in Luxembourg and are recognised collective investment schemes under section 264 of the Financial Services and Markets Act 2000. Swiss Pictet funds are only registered for distribution in Switzerland under the Swiss Fund Act, they are categorised in the United Kingdom as unregulated collective investment schemes. The Pictet group manages hedge funds, funds of hedge funds and funds of private equity funds which are not registered for public distribution within the European Union and are categorised in the United Kingdom as unregulated collective investment schemes.