Summary

- The outlook for the global economy has improved over the past three months, but there may be less capacity to combat a recession when it comes. We discuss seven key macroeconomic themes we expect in 2020 and implications for investors.

- Recession risks have diminished, and we are more confident in our baseline forecast of a moderate recovery in global growth this year.

- But monetary policymakers now have even less space left to guard against future recessions.

- Thus, while "time to recession" has likely increased with last year's monetary easing, so has "loss given recession."

- Considering the outlook, we seek to invest with a bias to higher-quality positions, a very close focus on portfolio liquidity, and a diversified approach to generating income

As a turbulent year for the global economy, financial markets, and politics recedes in the rearview mirror, we look ahead into 2020, mapping out both the likely path and the potential roadblocks for the economy and investors. This outlook draws on the work by PIMCO's portfolio managers, economists, and analysts in preparation for our recent quarterly Cyclical Forum, the lively discussions among our investment professionals at the event itself, the presentations by our sector specialists during the following two strategy days, and the investment conclusions drawn by our Investment Committee afterward. (For more details on our process, visit the Our Process page.)

Last year was not for the fainthearted: Global growth was "synching lower" and entered a "window of weakness," the U.S.-China conflict and Brexit uncertainty provided dark mood music, climate concerns took center stage amid extreme weather around the globe, and protests against the political establishment reverberated through Hong Kong, Lebanon, Chile, Ecuador, and many other places. And yet, spurred by global monetary easing led by the U.S. Federal Reserve's dovish pivot in early 2019, both equities and bonds had a year of stellar returns.

Looking ahead, we don't pretend to know what 2020 will bring in terms of economies, politics, and markets - nobody does. But in order to invest, we must couple our rigorous bottom-up portfolio process with taking an educated guess on the most likely baseline and, even more importantly, the skew of risks and opportunities around that baseline compared with what is priced into markets. That's why we spend much time at our quarterly forums mapping out different scenarios with the help of data, models, and premortems (as recommended by PIMCO advisor and Nobel laureate Richard Thaler) in order to check our biases, challenge our own and others' consensus views, and generate investment ideas that will help us manage the risks and target the opportunities we identify.

Seven macro themes for 2020

Based on the discussions during and following last month's forum, here are our key macro themes for 2020 and how we position portfolios for each of them.

1. ‘TIME TO RECESSION' HAS INCREASED

Recession risks, which had been elevated during the middle part of 2019, have diminished in recent months, helped by additional global monetary easing, a trade truce between the U.S. and China, better prospects for an orderly Brexit, and early signs of a rebound in the global purchasing managers' indices (PMIs). This assessment is corroborated by an easing of the 12-month-ahead recession probabilities for the U.S. estimated by our various U.S. recession models.

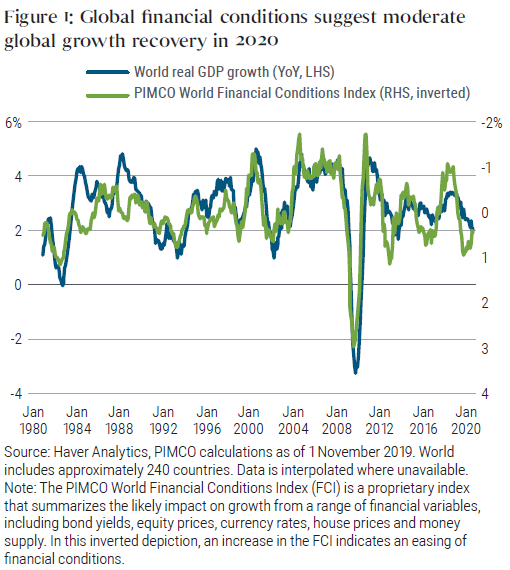

As a consequence, we are now more confident in our baseline forecast that the current window of weakness for global growth will give way to a moderate recovery during 2020. World GDP growth, which has been slowing over the past two years, has yet to bottom. However, PIMCO's World Financial Conditions Index, which tends to lead output growth, has been easing (rising) in recent months, pointing to a moderate cyclical growth recovery in the course of this year (see Figure 1).

Another factor underpinning a likely pickup in global growth this year is the supportive stance of fiscal policy in major economies such as China, Europe, and Japan. With fiscal and monetary policy now working in the same direction - further easing - in almost all major economies, the outlook for a sustained economic expansion over our cyclical horizon has improved. For snapshots of our economic outlook in the major economies, see the section on our regional forecasts further below.

Investment implications of Theme 1

We expect to run a little less duration in our portfolios, with duration close to flat as our starting point and adjusted from there depending on the balance of risk positions in the portfolio. We want to have a constructive approach, with positive carry versus benchmarks, in order to seek to generate income and outperform in the baseline scenario. But we will do this with a bias toward higher-quality positions, a very close focus on portfolio liquidity, and a preference for a diversified approach to generating income. We prefer not to rely excessively on generic corporate credit given concerns over valuations and market liquidity, and the potential for poor performance amid a worse macro outcome than we are expecting or in the event of an overall rise in market volatility in which investors demand a higher risk premium for investing in corporate credit. Within credit, we expect to favor financials over industrials. In asset allocation portfolios, we expect to have a modest overweight to equities, with profit growth likely to provide support in spite of fairly elevated valuations.

To read our six other key macro themes for 2020, please click the link below.

Important Information

This message contains confidential information and is intended only for the individual named. If you are not the named addressee, you should not disseminate, distribute, alter or copy this e-mail. Please notify the sender immediately by e-mail if you have received this e-mail by mistake and delete this e-mail from your system. E-mail transmissions cannot be guaranteed to be secure or without error as information could be intercepted, corrupted, lost, destroyed, arrive late or incomplete, or contain viruses. The sender, therefore, does not accept liability for any errors or omissions in the contents of this message which arise during or as a result of e-mail transmission. If verification is required, please request a hard-copy version. This message is provided for information purposes and should not be construed as a solicitation or offer to buy or sell any securities or related financial instruments in any jurisdiction. Please note to the extent that we collect any personal data we will use that personal data in accordance with our Privacy Policy https://europe.pimco.com/en-eu/general/legal-pages/privacy-policy#howweuseyourdata. PIMCO Europe Ltd is registered in England and Wales Company No. 2604517 and has its registered office at: 11 Baker Street, London, W1U 3AH.