Veteran investor Warren Buffett has said a Greek exit from the eurozone could be constructive for the region.

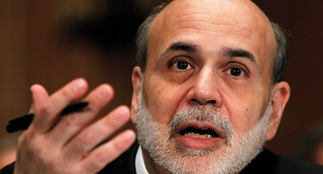

Buffett (pictured), chief executive and chairman of Berkshire Hathaway, said Greece leaving the single currency could help other member countries reach better policy agreements. "If it turns out the Greeks leave, that may not be a bad thing for the euro," the billionaire investor told CNBC. "It could be a good idea in several ways if everybody learns the rules mean something." Buffett added the euro has structural problems that need to be addressed, and "it is not ordained" that the euro area must have "exactly the same members it has today". "The euro is not dead and it may never ...

To continue reading this article...

Join Investment Week for free

- Unlimited access to real-time news, analysis and opinion from the investment industry, including the Sustainable Hub covering fund news from the ESG space

- Get ahead of regulatory and technological changes affecting fund management

- Important and breaking news stories selected by the editors delivered straight to your inbox each day

- Weekly members-only newsletter with exclusive opinion pieces from leading industry experts

- Be the first to hear about our extensive events schedule and awards programmes